Rental Applications & Legal Protections for Tenants

As a possible tenant, you must expect a property owner to evaluate you prior to authorizing the lease. Problems that the property manager probably intends to deal with include whether you are likely to take appropriate care of the residential property, whether you pay lease in a timely manner, whether you unreasonably grumbled to previous proprietors, and whether you caused troubles with your previous fellow tenants or next-door neighbors. If you have a pet dog, for example, the proprietor will certainly intend to confirm that you recognize how to control it to make sure that it does not interrupt others.

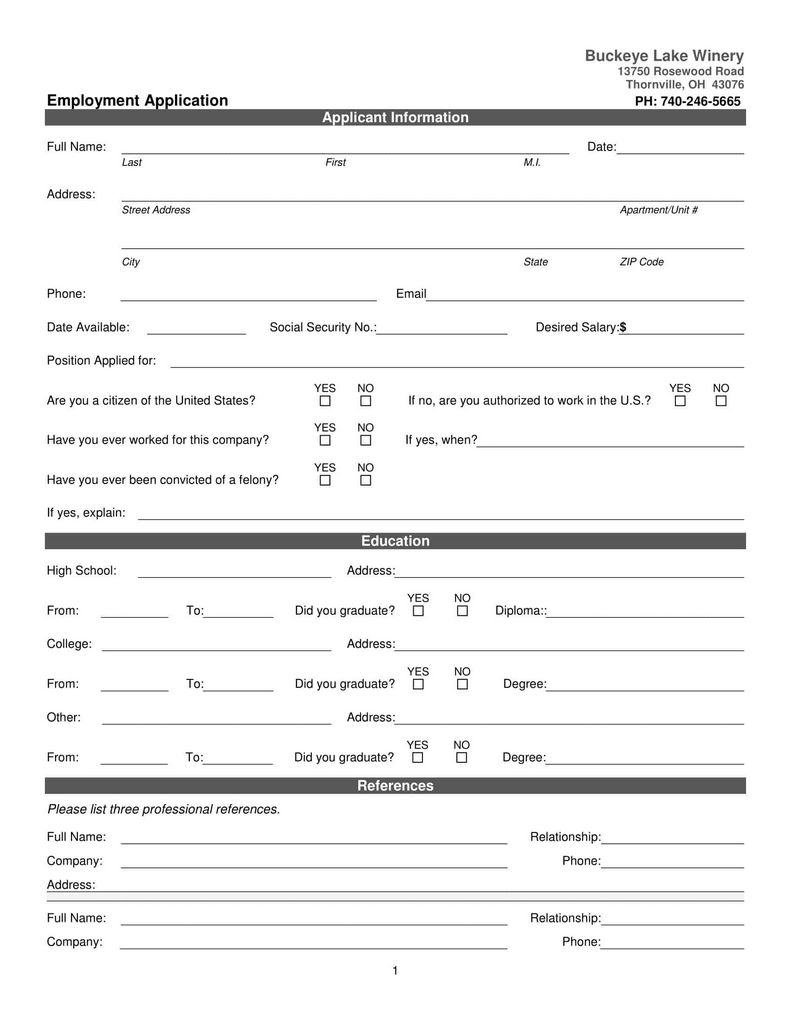

Details Covered on a Rental Application

Some of the usual problems attended to on rental applications consist of a prospective renter’s criminal history, credit report, and any kind of previous expulsions by prior proprietors. Landlords might inquire about the nature of your employment and earnings resources, and people that are self-employed may be extra very carefully vetted.Read about Access Virginia Lease Application online At website While landlords can not differentiate on the basis of immigration status, they can request evidence of an international national’s lawful status in the united state. They can also request identifying details like a Social Security number or chauffeur’s permit.

In many cases, a possible occupant may pick to fulfill a property owner with a finished rental application already in hand, together with their credit rating report and references from prior proprietors and others. This is not called for but can be a means to start the partnership on a strong ground.

A property manager might desire more info concerning a potential renter’s pet dog. It may be a great idea to gather positive references from previous proprietors or neighbors and any other evidence of etiquette, such as obedience or training certifications.

History and Referral Checks

Instead of taking the details on the application at stated value, proprietors will generally follow up by checking it with a prospective lessee’s property owners. They additionally might ask a company or a credit report reporting firm to validate information pertaining to income and credit score. Landlords must get a finished approval form from a renter to do this, yet providing this consent is standard.

Renters do have legal rights throughout this procedure. Landlords may not use the history check process to aid the discriminate against certain teams whom they do not want on their building, such as groups defined by race, religion, or nationwide beginning. They likewise are not permitted to ask pointless questions that get into a possible occupant’s privacy. The permission form ought to be worded in a manner that protects the legal rights of lessees by limiting the scope of the details offered to the proprietor.

If you had an aggressive relationship with your existing property manager or a prior landlord, you might intend to offer your side of the story before they offer their own. You could be able to offer a potential property owner with authorities reports going over safety issues if this was an aspect, or there may be public documents revealing code infractions by the existing or prior proprietor, as an example.

3rd parties whom the proprietor get in touches with are not required to connect with the landlord, even if the occupant has completed the approval type and even if the tenant asks to give details.

Inspecting Credit Scores Reports

Landlords typically will certainly wish to consider a potential tenant’s credit report. They can learn if you have actually been late in paying your rental fee, evicted, founded guilty, or otherwise involved in litigation at any time in the last 7 years. Additionally, they can figure out whether you have actually declared insolvency in the last 10 years. Possible renters may need to pay a small charge to cover the cost of the check. They might also intend to carry out a check on their very own ahead of time so that they can fix any kind of troubles or prepare an explanation for them.

The government Fair Credit scores Coverage Act gives you the right to figure out the identity of a credit history coverage agency that reported unfavorable info about you if this caused a property manager rejecting you or billing higher rental fee. You have a right to get a complimentary copy of your file from the company, but you should request it within 60 days of the property manager rejecting you. You can challenge the precision of the information in the record, although the property owner will certainly notify you that the company did not make the decision not to lease to you and is exempt for discussing why you were declined.